Sterne Agee & Leach maintains a positive attitude towards Penske Automotive Group and Group 1 Automotive Inc., two of the largest automotive parts stocks on the market, but says that although the two have gained value over several months, the analysts believe they have largely discounted most of their near-term momentum.

Penske shares are up 65.5 percent for 2012 while Group 1 shares are up a more modest 24.3 percent for the year. The largest gains for those averages have happened since late June, when supply chains for automotive usually become very active as they anticipate the coming model year's sales.

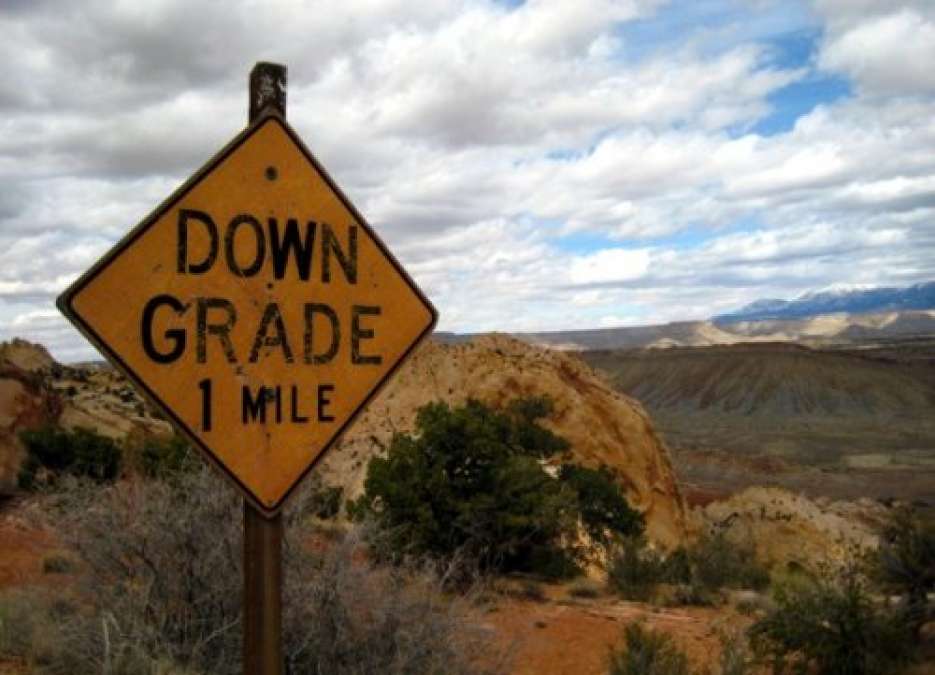

SA&L's reasoning for downgrading these growing stocks are based on two expectations for 2013. First, it is expected that many companies will face more severe ratings for 2013 as new, tougher business comparisons are implemented. Second, a "fiscal cliff" (dropoff in activity) is expected to happen early to mid-year in 2013 due to several economic issues in the financial and currency markets.

The analysts believe that these two things will negate many of the gains seen by the stronger of the automotive supply chain and auto parts in particular.

Both stocks lost small percentage points on the news yesterday. As revenues grow for the season, however, they could recover and continue growth through the rest of the year.

Many other related stocks are also dipping by similar percentages, likely as analysis from SA&L and others implies similar drops for the rest of the sector.