China alone is expected to see growth of 16 percent, with much of the growth moving beyond the large metropolitan cities of Shanghai and Beijing.

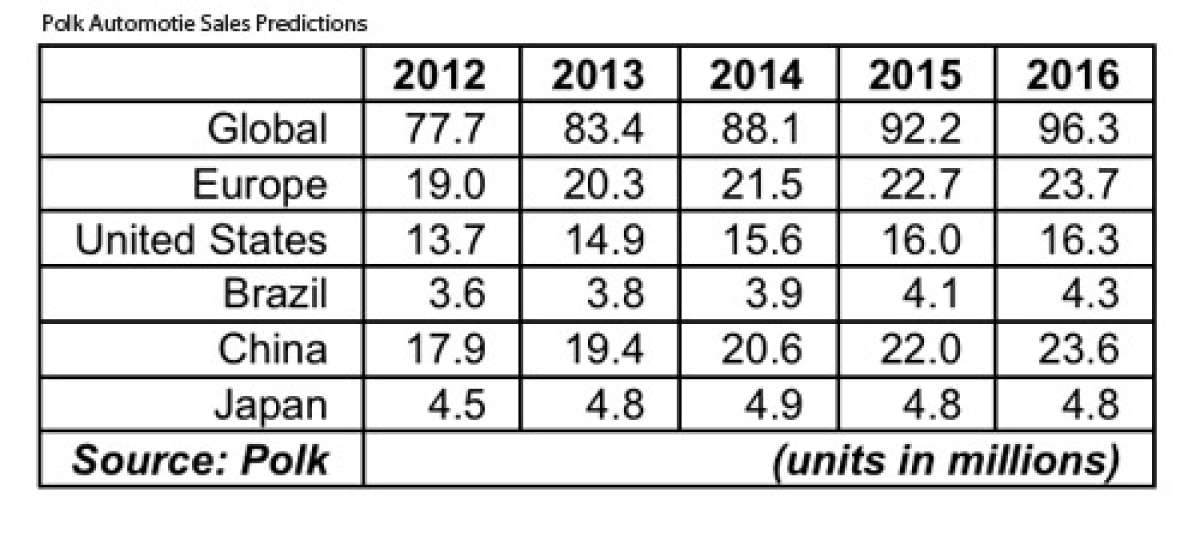

The U.S. market is only expected to experience single digit growth, a result of the sales jump in 2011 plus a still anemic economy that may continue to affect new vehicle demand during 2012. Light vehicle sales will grow at a moderate pace, with a 7.3 percent increase in the region this year, to 13.7 million vehicles, according to Polk’s analysts. In their eyes, the U.S. market won’t achieve pre-recession levels of over 16 million vehicles annually until 2015. Growth is expected in the U.S. luxury market during 2012 at over 14 percent.

"More affluent buyers are returning to the market for new vehicles, after three years of spending reductions," said Anthony Pratt, director of forecasting for the Americas at Polk. "The luxury segment also offers a wide variety of product options for consumers across all segments, ranging from small cars to SUVs," he said.

Leasing will continue to grow in the U.S. luxury segment, continuing to add to transactions in all segments, thanks to elevated residual values reducing monthly payments. Leasing transactions have increased to pre-crisis levels through October last year at 41.5 percent for luxury vehicles and 17.1 percent overall. This trend is likely to continue through 2012 as automakers attempt to bring back shoppers with promotions focused on monthly payments.

Flat sales are expected in Europe where the total may even shrink slightly at roughly 19 million units. Austerity plans will keep governments from boosting 2012 sales through replacement programs and other such incentives in previous years.

Growth in the other BRIC countries is expected to continue outpacing many traditional markets during the next few years. For example, Polk predicts Brazil will surpass Germany as 2011 sales results are finalized, while new vehicle sales in India are expected to eclipse German sales in 2014. Though sales in Russia will probably be flat in 2012, Polk thinks Russian sales will outgrow Germany by 2015.

Toyota and Honda should experience market share growth in 2012, regaining some of what was lost from their 2011 inventory shortages. They will probably not regain all that was lost due to strong competition from other automakers that are now offering more fuel-efficient vehicles with a growing array of infotainment features.

Volkswagen is almost certain to continue gaining U.S. market share next year, at close to three percent, as the new Beetle launch builds on successful Passat and Jetta models.

Hyundai and Kia sales volumes have been growing year after year, but in 2012 their market share growth will be flat, as they face increased competition in all segments.

General Motors, Ford and Chrysler are expecting continued growth in 2012 as the industry continues to recover. Refreshed models and new product introductions will help to keep them competitive in various segments.

Polk's global forecasting team analyzes market trends by region and serves as a comprehensive resource for manufacturers, dealers and suppliers to the light and commercial vehicle markets. Polk's complete light vehicle sales forecast (including passenger cars, light trucks and light commercial vehicles) through 2016 appears above right.